Phoenix Motor Stock: 3 Key Risks That Point To Further Declines

Mario Tama

Phoenix Motor (NASDAQ:PEV) stock was one of the biggest losers on Tuesday (July 5th) trading after the market reopened from the Independence Day long weekend. The stock lost more than 20% of its value overnight, a stark contrast to its late June rally. Despite a brief relief rally on Wednesday (July 6th), the stock is once again in the red today (July 7th), and is now trading at close to a 50% discount to its IPO price of $7.50 apiece.

While company valuations have been battered across the board with rising borrowing costs and surging inflation threatening a recession, PEV’s recent losses in market value is likely a reflection of its idiosyncratic risks. Considering PEV’s legacy business in the development and sales of electric commercial vehicles that primarily relies on third-party technologies and components, its current operational prospects are exposed to significant vendor concentration risks. Recognizing the issue, as well as the massive market opportunities within the emerging electric vehicle (“EV”) sector in coming years, PEV is now pitching a pivot to the development of its proprietary electric vehicle (“EV”) platform from ground-up, accompanied by the introduction of a new passenger EV brand to service the consumer segment.

However, with much of its current aspirations still in early development stage, and a legacy business that has consistently incurred losses over the past 20 years of operations, the investment outlay ahead will be a significant burden on PEV’s balance sheet. The company faced “substantial doubt” on its ability to continue as a going concern as of December 31, 2021, and the capital raised during its early-June IPO was merely a lifeline that foreshadows the beginning of more equity fundraising, and inadvertently, dilution to come.

PEV exhibits substantial investment risks that could potentially hamper its ability to capitalize on upsides in tandem with the EV sector’s rapid growth trajectory. The combination of imminent share dilution and over-reliance on a concentrated volume of vendors over at least the next two years – the anticipated timeline in which PEV is expected to deliver its own proprietary products – means the stock will likely face further price declines ahead, especially under the current market climate.

Phoenix Motor Business and IPO Overview

PEV currently operates under two brands: 1) Phoenix Motor, and 2) EdisonFuture.

Phoenix Motor: Phoenix Motor refers to PEV’s primary legacy business, which partakes in the development and sales of commercial electric vehicles, such as medium-duty EVs and electric forklifts, under its “Zero-Emission Commercial Product Line”.

Phoenix Motor’s medium-duty EV offerings, priced between $165,000 to $220,000, are represented by the “Zero-Emission Utility Shuttle” or “ZEUS” product line, which includes the ZEUS 400 Electric Shuttle Bus, ZEUS 500 Electric Trucks, and ZEUS 600 Electric Type A School Bus. The electric drivetrain that powers the ZEUS product line was developed by PEV. With range capability of 160 miles on a single charge, PEV claims that its ZEUS product line boasts the “longest electric range for any Class 4 product on the market”. In addition to selling the fully assembled ZEUS vehicles, PEV also sells “kits” for its proprietary drivetrain to OEMs for integration into their commercial EVs.

PEV currently operates under an “asset light” business model, with significant reliance on technologies provided by third-party vendors, and manufacturing and sales capabilities offered by third-party service providers. For example, the ZEUS drivetrain is specifically designed for integration into Ford’s (F) “E-450 Superduty Chassis”. This means if Ford discontinues supply of the E-450 base frame, ZEUS would be “on the line” (related risks discussed in sections further below).

PEV also places significant reliance on its sales partner “Creative Bus Sales”, the largest bus dealer in the U.S., on marketing and selling its vehicles. With annual in-house production capacity of only 120 vehicles on a single daily shift and 240 vehicles on a double daily shift at its Anaheim facility, PEV also relies significantly on its outsourced production agreement with “Forest River”, one of the largest commercial vehicle manufacturers in the U.S., to assemble its commercial EVs.

Phoenix Motor also sells level 2 AC chargers ranging from 7.2 kilowatt to 19.2 kilowatt, and direct-current fast chargers ranging from 30 kilowatt to 350 kilowatt to its existing ZEUS customers. The company intends to expand its charging solution offerings to both “residential and multi-family markets in both networked and non-networked configurations” in the future.

In addition to the ZEUS commercial EVs and related charging solutions, Phoenix Motor also offers a range of electric forklifts and pallet jacks designed to accommodate different customer needs. The Class 1 electric forklifts are powered by lithium-ion batteries, with three capacity options ranging 4,000 lbs, 5,000 lbs, and 7,700 lbs. Phoenix Motor also offers three different models of pallet jacks to accommodate different “operation intensity applications”.

EdisonFuture: EdisonFuture is a separate brand that PEV has created in 2021 to focus on the development of its light-duty EV offerings. With the help of its design partner “Icona Design” (“Icona”), EdisonFuture debuted its first two concept models – the EF-1 pickup truck and EF-1 V delivery van – at the LA Auto Show in Novembe

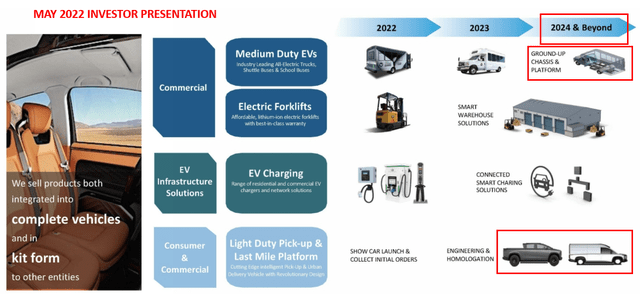

r 2021. The two vehicles are designed to incorporate “distinct features including solar roof, interior solar mosaic, and retractable solar panels for the pickup bed cover”. Based on PEV’s latest Investor Presentation dated May 2022, the anticipated timeline for the launch of a production-ready EF-1 pickup and EF-1 V delivery van is still more than two years out.

IPO: PEV went public on June 8th via a traditional IPO, offering 2.1 million shares at $7.50 apiece. Net of underwriter fees “equal to 7% of the gross proceeds of the offering” and other offering expenses, PEV raised $14.3 million from its IPO.

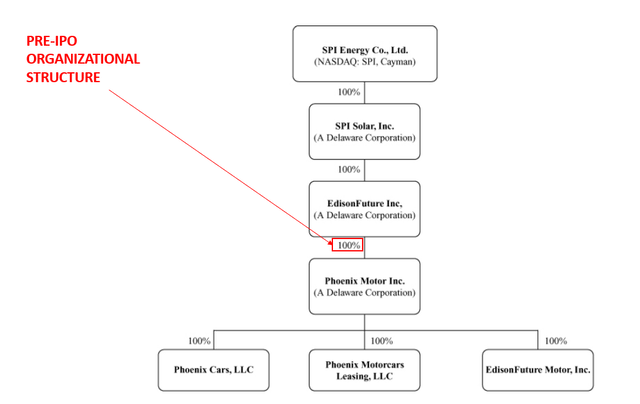

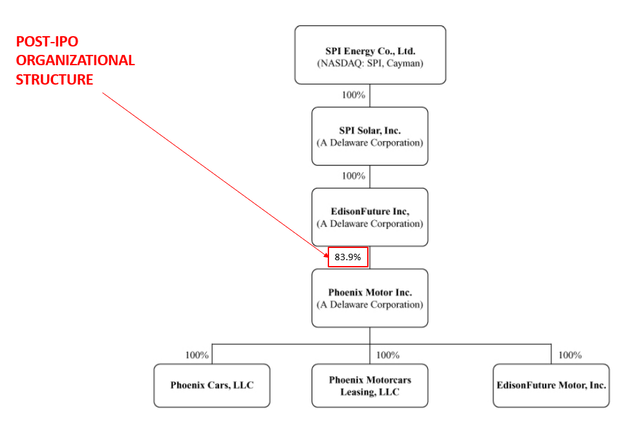

PEV was essentially the EV unit spun-out from SPI Energy (SPI). Following PEV’s debut on Nasdaq, SPI Energy’s stake in the EV company falls from 100% to 83.9%, held via its wholly-owned subsidiary and PEV’s direct parent company EdisonFuture, Inc.

PEV Pre-IPO Org Structure (PEV Form S-1) PEV Pre-IPO Org Structure (PEV IPO Prospectus)

The PEV stock lost about half of its value immediately following the June 8th IPO, but recovered during a strong two-day rally in late June. However, the stock has been on a consistent decline since, trading at an approximately 50% discount to its IPO price again despite broad-based gains observed across the EV sector on July 5th.

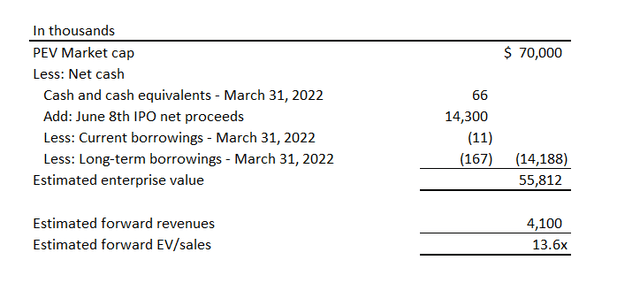

Given a market cap of about $70 million, and post-IPO net cash of about $14.2 million (i.e. IPO net proceeds $14.3 million + $66K cash and cash equivalents as of March 31, 2022 –$178K long-/short-term borrowings as of March 31, 2022), PEV’s current enterprise value is estimated at about $55.8 million (i.e. market cap $70 million, less post-IPO net cash $14.2 million). Using PEV’s confirmed backlog orders of 37 vehicles valued at $4.1 million per its February 2022 Roadshow Presentation as a proxy for projected forward sales, which is consistent with prior year results (2021: $3.0 million; 2020: $4.5 million; 2019: $4.0 million), the stock is trading at forward EV/sales of about 13.6x. This compares to the peer average of about 11.3x EV/’22 sales – or 92.0x inclusive of Fisker’s (FSR) EV/’22 sales valuation multiple of 334.0x – and 4.5x EV/’23 sales (range: 1.3x to 8.3x).

PEV Estimated Forward EV/Sales (Author)

Considering PEV’s significant concentration risks, duration-characterized business nature given its infancy stage of development, and high financial risks pointing to significant share dilution in the near-term, the stock’s current valuation premium over the EV industry average will likely diminish further. Key catalysts required for a structural turnaround would include significant milestones (e.g. final design lock-in, advanced testing, launch of production-ready products, start of productions, etc.) to PEV’s current development of its proprietary “Ground-Up Platform” and light-duty EVs, which is slated for 2024 and beyond, and continued acceleration to its order book growth.

1. Concentration Risks

Based on PEV’s disclosure on concentration risks in its Form S-1 filing, the company had three customers representing 19.1%, 18.9% and 12.9% of its consolidated revenues as of December 31, 2021. This is consistent with our understanding of PEV’s commercial EV business operates at a significantly smaller scale compared to peers in the electric class 4 vehicle business like Ford and Blue Bird Corporation (BLBD). Over the past three years, PEV’s revenues generated from its commercial EV business had spanned from $3.0 million to $4.5 million on an annual basis, which is equivalent to sales of about 15 to 23 vehicles per year based on an average sale price of $192,500. With the majority of its customers being fleet operators, it is not unusual for one to account for a double-digit percentage of PEV’s annual sales.

Meanwhile, it is the concentration of PEV’s vendors that is of concern. The company had one vendor representing 31.0% of its total purchases made in the year ended December 31, 2021. While the name of the specific vendor is not disclosed, it is likely Ford, which supplies PEV with the E-450 chassis that the entire ZEUS class 4 EV product line is built on. PEV’s significant reliance on the E-450 chassis from Ford raises several concerns on the sustainability of its commercial EV business.

First is PEV’s continued exposure to risks of high accommodation costs. The current drivetrain in which PEV has developed for its ZEUS product line is designed for integration into Ford’s E-450 chassis released in the 2019 model year. However, based on PEV’s Form S-1 filing, the newest Ford E-450 chassis released in the 2021 model year had significant alterations that would require PEV’s existing drivetrain for its ZEUS vehicles be re-engineered. Specifically, the current “GEN-3” drivetrain system introduced in 2021, which is due for an updated release by the third quarter, had to be redesigned to accommodate both the 2019 and 2021 model year E-450 chassis. This underscores the requirement for additional costs that could potentially delay PEV’s margin expansion trajectory, and risk the continuation of recurring losses that have been a significant cash burden on the company since its inception.

PEV’s significant reliance on Ford’s supply of E-450 chassis also risks holding back its ability to fund the development of the new EdisonFuture passenger EV brand, as well as its proprietary Ground-Up Platform, considering the high accommodation costs required to sustain its current legacy commercial EV operations. PEV’s next-generation “GEN-4” drivetrain for the ZEUS product line, scheduled for launch in the fourth quarter, is also designed for integration into Ford’s E-450 chassis. It is not until 2024 when PEV’s proprietary Ground-Up Platform is expected to enter productions. This means PEV will continue to be exposed to risks of higher accommodation costs should Ford’s E-450 chassis specifications change again over the next two years. Considering the rapid evolution of electrification needs within the transportation sector in recent years, as well as Ford’s significant investments into its electrification efforts, it is highly likely that the blue oval brand’s class 4 chassis offerin

gs will see further changes in coming years, which creates a significant overhang on PEV’s commercial EV margins in the near-term.

PEV’s significant reliance on Ford’s E-450 chassis also makes it a price-taker within the increasingly competitive EV landscape. And PEV’s small scale of operations further exacerbates the situation, given its order volumes are likely insufficient to secure improved supply pricing, adding to the myriad of factors that continue to weigh on PEV’s margin expansion prospects. Especially under the current operating environment, where the automotive industry is experiencing one of the worst supply chain snarls in the industry, PEV’s concentrated reliance on Ford’s base frames subjects the business to significant risks of inflated input costs and delivery delays. This is further corroborated by the fact that PEV has not entered into any long-term supply contracts with its vendors to guarantee pricing and availability on vital parts and components for its vehicles (except battery supplies), despite its existing business’ significant reliance on Ford’s chassis to sustain operations.

PEV also lacks competitive advantage within the increasingly crowded commercial EV market given its continued reliance on a sole third-party’s base frame offering. With its sole base frame supplier Ford – one of the best-selling light- and medium-duty commercial vehicle brands in the U.S. – accelerating its electrification efforts, it is likely that PEV’s small market share will diminish further in the near-term, worsening the already beleaguered business.

2. Infancy Stage of Development

The electric light- and medium-duty commercial vehicle market exhibits significant growth opportunities over the next decade, especially with increasing adoption momentum buoyed by lowered total ownership costs, increasing availability of fast charging solutions to accommodate, and improved battery technologies aimed at accommodating fleet operators’ needs. Global demand for electric medium-duty vehicles – like those offered by PEV’s existing Phoenix Motor business – is expected to expand rapidly over coming years, with related sales estimated to advance at a compounded annual growth rate (“CAGR”) of more than 13% over the next five years and more than 17% through to 2030.

While the above market growth projections portray favourable trends for PEV, the infancy stage of its pivot in corporate strategy from reliance on third-party EV technologies to developing its own proprietary technologies might limit its ability in capitalizing on related opportunities in time. For one, PEV’s continued reliance on Ford’s chassis in its next-generation drivetrains, as discussed in earlier sections, could further hamper the company’s already-slow market share growth. And having both of its longer-term growth initiatives – namely the development of the proprietary Ground-Up Platform and the brand-new EdisonFuture light- and medium-duty EV product line – still in early concept phase does not make the situation any better.

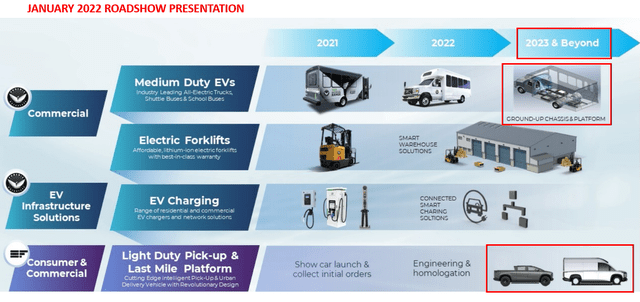

PEV is in a particularly troublesome disadvantage, considering how both legacy automakers and upstarts competing for market share gains in the light- and medium-duty commercial EV market have already either launched production-ready prototypes or are already in process of scaling up sales and productions. Based on material disclosed per its IPO filings to date, PEV has nothing more than design concepts for its upcoming new offerings. There is no concrete timeline for start of productions on the Ground-Up Platform nor the EF-1 pickup trucks and EF-1 V delivery vans, with the ballpark launch date delayed from “2023 and beyond” to “2024 and beyond” within a matter of just months between the January 2022 Roadshow Presentation and the May 2022 Investor Presentation. This implies that the company may still be a long way from even finalizing a plan for key development milestones, such as locking in designs, parts and components, prototypes and testing.

PEV Planned Development Timeline (PEV January 2022 Roadshow Presentation) PEV Planned Development Timeline (PEV May 2022 Investor Presentation)

There is also lacking context on whether PEV’s new developments will place significant reliance on third-party technologies again. The company seems to be relying significantly on its design partner Icona for its future offerings, with only one in-house technical expert in autonomous driving that has recently been hired to specifically accommodate the development of its Ground-Up Platform. Although autonomous driving technology development is a lengthy, costly and difficult process, we do believe PEV’s consideration to incorporate it in its next-generation offerings is a step in the right direction.

Meanwhile, based on disclosures within its Form S-1 filing, the company has no intentions of developing its own battery technology, and plans to rely on third-party vendors to “meet the technological requirements, production timing and volume requirements to support [PEV’s] business plan”. It is currently uncertain whether the disclosure intends to convey that PEV will be relying on third-party battery supplies, which is not unusual within the EV industry, or if the company intends to incorporate “off-the-shelf” battery technology offerings into its next-generation vehicle and platform offerings. The latter option could imply that PEV will lack competitive advantage within the heated “range race” that has already taken place within the sector, and further prohibit its market share gain prospects in the long-run.

With regards to PEV’s planned EdisonFuture offerings, the company also has big goals of incorporating unique features, such as solar charging capabilities, into the new brand’s vehicles. While PEV’s relationship with parent company SPI Energy – a leading photovoltaic solutions provider – might have potentially played a role in the EV maker’s solar roof aspirations, it will likely be a costly endeavour to develop and scale in the long-run. The only two production-ready vehicles that have successfully incorporated solar roofs right now are Hyundai’s Ioniq 5 (OTCPK:HYMTF / OTCPK:HYMPY / OTCPK:HYMPF) and the Fisker Ocean (start of productions November 2022).

Let’s take the Fisker Ocean SUV as a gauge for EdisonFuture’s potential investment outlay, considering the consistency of Fisker’s “asset light” business model with PEV’s. Fisker raised $1 billion via a reverse SPAC merger with Spartan Energy Acquisition Corp. in October 2020. All proceeds from the transaction were allocated towards the “development of the Fisker Ocean program through the planned start of production in Q4 2022”. Fisker has also provided regular spending updates on its Fisker Ocean program in past earnings calls, indicating it has already spent hundreds of millions of dollars on the development of its flagship SUV.

This underscores the extent of capital that PEV will be required to spend over the next two or more years to fund the development of its Ground-Up Platform, as well as the EF-1 pickup trucks and EF-1 V delivery vans that will feature proprietary in-vehicle photovoltaic charging solutions. However, its balance sheet only boasts cash on hand of a little more than $14 million following the completion of its recent IPO. Paired with continued losses expected in its legacy commercial EV business, PEV is poised for continued financial burden in the near-term, with a likely recurring requirement to tap into public markets for debt or equity fundraising to keep its business and growth aspirations afloat in coming years.

3. Share Dilution Risks

Recall that prior to PEV’s IPO, the company was in substantial doubt of operating as a going concern as of December 31, 2021, and March 31, 2022. This means the company was in a position where if it did not have access to additional funding, it would be at risk of running out of cash to meet its capital requirements over the 12-month period following its last reporting date.

Lucky enough, the company successfully IPO’d on June 8th, raising net proceeds of about $14.3 million after underwriters’ commission fees and other filing expenses. Yet, considering its accumulated deficit of $18.2 million and working capital deficit of $271,000 as of March 31, 2022, as well as its significant investment outlay in coming years to support ongoing growth aspirations, PEV will be required to raise additional funds within the near-term. The company has also stated its intentions to incorporate rigours cost-savings initiatives at the same time to alleviate its cash crunch. These initiatives include:

- Reducing payroll and expenses that will not generate cash in the short-term: We believe this initiative contradicts PEV’s intentions to revamp its offerings and better position itself for the significant growth opportunities presented by the rapid electrification of the transportation sector over coming years.

- Reducing R&D expenses on next-generation products if an IPO is not successful: With the IPO successfully raising net proceeds of $14.3 million on June 8th, the company will likely be able to continue with its development of next-generation products that include the Ground-Up Platform, as well as the EdisonFuture brand’s EF-1 pickup trucks and EF-1 V delivery vans. However, as mentioned in earlier sections, the investment outlay related to these next-generation developments will range from hundreds of millions of dollars to billions. This makes the $14.3 million raised from PEV’s recent IPO merely a drop in the ocean compared to what is required to support the entire process from development to start of productions on its next-generation offerings.

- Implementing comprehensive budget control: While management has not provided detailed context on what the general statement implies, comprehensive belt-tightening across the business might again be contradictory to its near-term R&D goals.

With its intended cost-savings measures unlikely to make a substantial impact on supporting its near-term capital requirements, PEV will likely need to raise additional capital either via debt or equity to fund its current R&D efforts through materialization.

If PEV raises additional capital through debt, it will be a costly endeavour under the current macroeconomic environment. With central banks embracing an increasingly aggressive policy tightening stance that includes steep interest rate hikes to keep runaway inflation at bay, borrowing costs have surged, causing global debt volumes to “decline for the first time in eight years”. And considering PEV’s weak balance sheet and recurring working capital deficit, debt financing via the public markets might also not be an option for the company – at least not without a high price to pay (e.g. significant collaterals, high borrowing costs, etc.).

In addition to high borrowing costs, PEV also has another incentive to stay away from debt financing, and that is to remain an “emerging growth company” under the JOBS Act. As an emerging growth company under the JOBS Act, PEV is exempt from certain disclosure and financial reporting requirements, such as the need for effective internal control over financial reporting, compliance with PCAOB rules regarding “mandatory audit firm rotation” on independence considerations, and communicating executive compensation details. And one of the criteria to remain an emerging growth company is to stay away from raising more than $1 billion in non-convertible debt within a three-year period from its IPO. While the $1 billion threshold might be sufficient to fund PEV’s near-term growth initiatives, the company’s intention to remain an emerging growth company for a maximum of five years might deter it from tapping into the debt capital markets altogether unless it has no other option.

Considering the two main reasons why PEV might be incentivized to abstain from capital raising through debt, the company will likely turn to additional equity fundraising over the next couple of years to fund its growth initiatives. This accordingly amps up share dilution risks for existing and potential PEV shareholders. Considering PEV’s cash burn rate of approximately $10 million to $13 million per year, the company will likely need to raise additional capital within the next 12 months to fund both its legacy commercial EV operations and new R&D initiatives. With valuations battered across the board under the current market climate, any equity issuances over this period will likely be unfavourable as well. This is further corroborated by the significant decline in equity issuance volumes observed in the first half of 2022, which is close to 70% down from volumes observed over the same period in 2021.

Is PEV a Buy, Sell or Hold?

Despite significant growth opportunities within both the light- and medium-duty passenger and commercial EV markets, PEV’s small sc

ale of operations today as highlighted by its small order backlog and limited in-house production capacity, as well as its still-uncertain prospects of ramping up new developments makes it an unfavourable investment at current levels. Trading at more than 13x estimated forward EV/sales, the PEV stock is valued at a slight premium to its peer group’s average. And this premium is likely buoyed by optimism over its next generation developments (i.e. Ground-Up Platform and EdisonFuture vehicles), rather than its existing legacy, money-losing medium-duty commercial EV business.

Considering the company lacks competitive advantage within the increasingly crowded EV landscape, alongside tight liquidity concerns that risks additional share dilution in the near-term and broad-based market volatility under the current macro climate, the stock will likely trend lower over coming months. We would remain cautious and stay on the side-lines regarding PEV until the company can show a consistent positive track record in crossing off key milestones – such as locking-in production-ready prototypes on new vehicles, completion of testing, and start of reservations – pertaining to its core long-term goals that underpin its valuation growth prospects.