Rising new and used car values drive motor finance’s continued growth

Significant new and made use of vehicle rates will keep on to travel the motor finance sector’s growth by price irrespective of a price tag-of-residing crisis that will “subdue buyer paying in the coming months”, the FLA has reported.

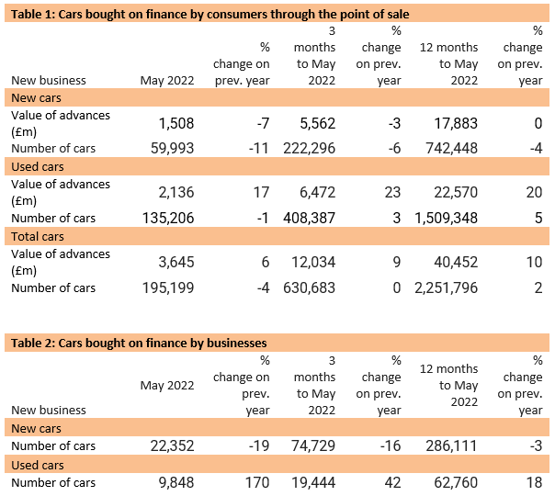

Industry knowledge printed by the Finance and Leasing Affiliation has discovered that that consumer automobile finance new organization volumes fell 4% calendar year-on-yr, to 195,199 models, in Might as the worth of new company grew by 6%, to £3.65 billion.

And the development of companies prioritising significant-benefit and electric vehicles (EV) amid the current supply shortages, and the effect of a deficiency of provide on employed automobile price ranges, seem set to guarantee the worth of the sector carries on to increase in spite of a rising price tag of residing crisis.

Geraldine Kilkelly, the FLA’s director of investigate and main economist, claimed: “May saw a continuation of latest traits in the shopper car finance market with auto shortages weighing on new company volumes in the new car finance marketplace, and greater new and applied motor vehicle prices main to even further growth in regular advances.

Geraldine Kilkelly, the FLA’s director of investigate and main economist, claimed: “May saw a continuation of latest traits in the shopper car finance market with auto shortages weighing on new company volumes in the new car finance marketplace, and greater new and applied motor vehicle prices main to even further growth in regular advances.

“Pressures on residence incomes from bigger inflation, curiosity prices and taxes are expected to subdue customer spending in the coming months.

“Growth in the value of buyer auto finance new business is envisioned to be reasonably modest at 4% in Q3 2022 and 5% in Q4 2022 compared with the exact quarter in 2021.”

Addressing the problem that some motorists might obtain them selves having difficulties to spend for their car or truck as tension on household incomes mature, Kilkelly added: “As always, clients who are fearful about assembly payments need to talk to their lender as quickly as doable to come across a remedy.”

The FLA’s data showed that the shopper new motor vehicle finance current market reported a year-on-calendar year drop in new company of 7% by worth, to £1.51bn, and 11% by quantity, to 59,993.

The shopper used auto finance current market described new company up 17% by price, to £2.14bn, but 1% lessen by volume at 135,206.

This reflects responses built by Cap HPI director of valuations Derren Martin who recently advised AM that the applied car or truck sector would be a “bloodbath” without limited provide trying to keep values high.

In the organization sector, the variety of new vehicles bought on finance in May slumped 19% in May to 22,352 as utilised car or truck gross sales funded by FLA users grew 170% to 9,848.

This reflects the data seen in the the latest Culture of Motor Producers and Traders (SMMT) new car registrations knowledge for June, which showed that OEMs are at this time prioritising private buyers around fleet and leasing businesses.