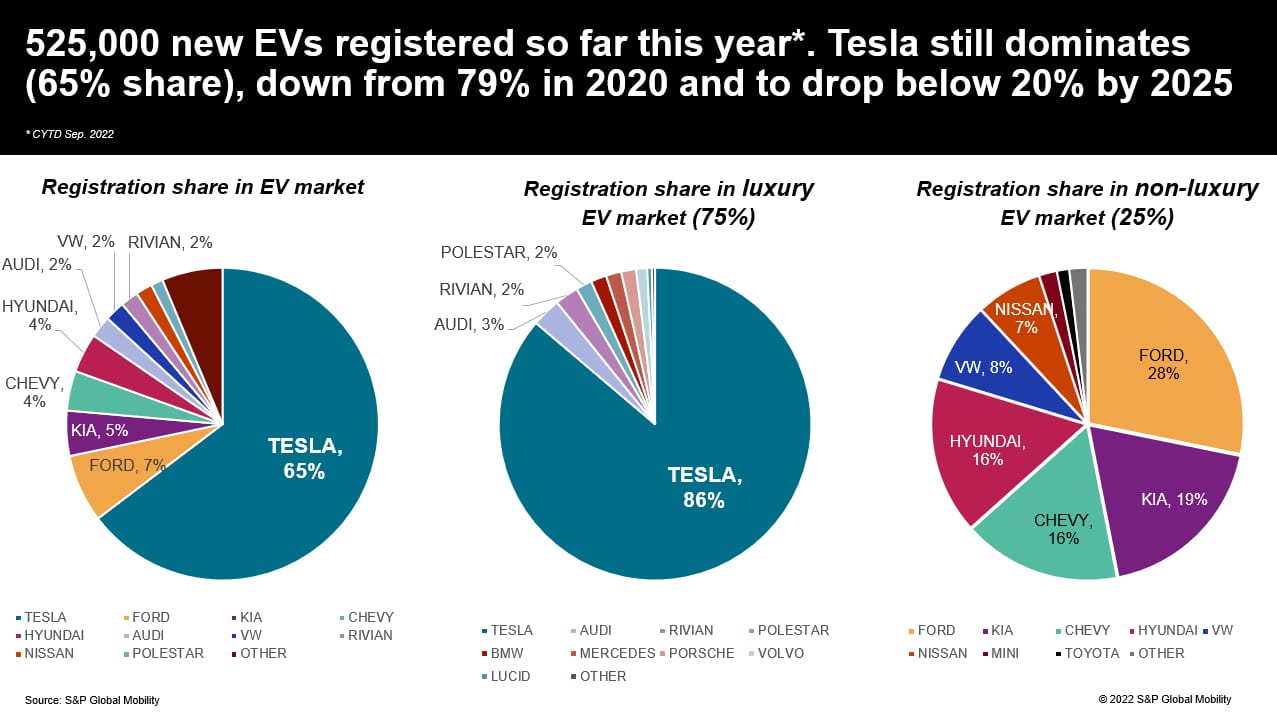

New EV entries nibbling away at Tesla EV share

Despite the fact that U.S. electric powered car or truck registrations continue being dominated by

Tesla, the brand is exhibiting the anticipated indications of shedding current market

share as a lot more entrants get there. Significantly of Tesla’s share decline is to EVs

available in a much more obtainable MSRP selection – under $50,000, where by

Tesla does not still actually contend.

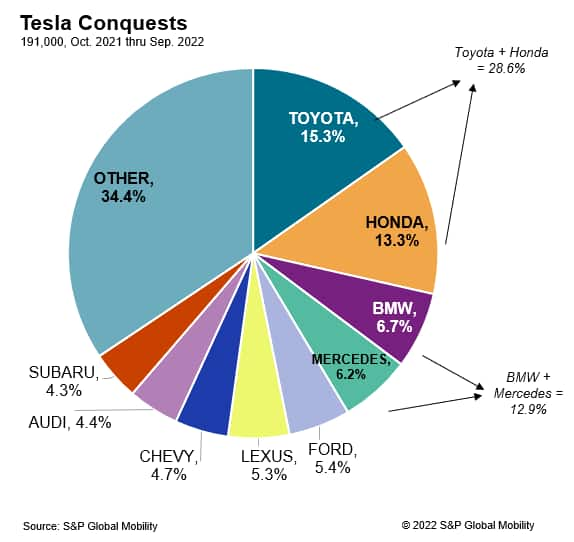

Regardless of brand or price tag position, early S&P World wide

Mobility details suggests customers relocating to electric vehicles in

2022 are mainly doing so from Toyota and Honda – manufacturers which have

been unable to retain their interior combustion homeowners faithful until finally

their very own makes commence to take part much more considerably in the EV

changeover.

Even though equally Japanese corporations developed a US legacy with phenomenal

fuel economic system and powertrain systems – like

electrification by hybrids, plug-in hybrids and gasoline-mobile

electric powered cars – both equally have been caught flat-footed in the

context of 2022. S&P World wide Mobility conquest details for Tesla’s

Product 3 and Y, Ford Mustang Mach-E, Hyundai Ioniq5, and Chevrolet

Bolt demonstrate powerful captures of buyers from the two primary Japanese

models.

Tesla’s problem

So significantly, most EVs proceed to be obtained for larger MSRPs and by

purchasers with increased incomes than the demographic profile for overall

light-weight automobile registrations–in aspect mainly because most EVs are

Teslas.

Of a lot more than 525,000 EVs registered more than the 1st nine months

of 2022, nearly 340,000 ended up Teslas. The remaining quantity is

divided, quite inconsistently, amid 46 other nameplates. Nonetheless, the

tendencies might improve as the quantity of EV purchasers will become more

strong.

Tesla’s placement is transforming as new, far more reasonably priced solutions

get there, supplying equal or superior engineering and creation construct.

Specified that customer selection and customer desire in EVs are

increasing, Tesla’s potential to keep a dominant market share will be

challenged going forward.

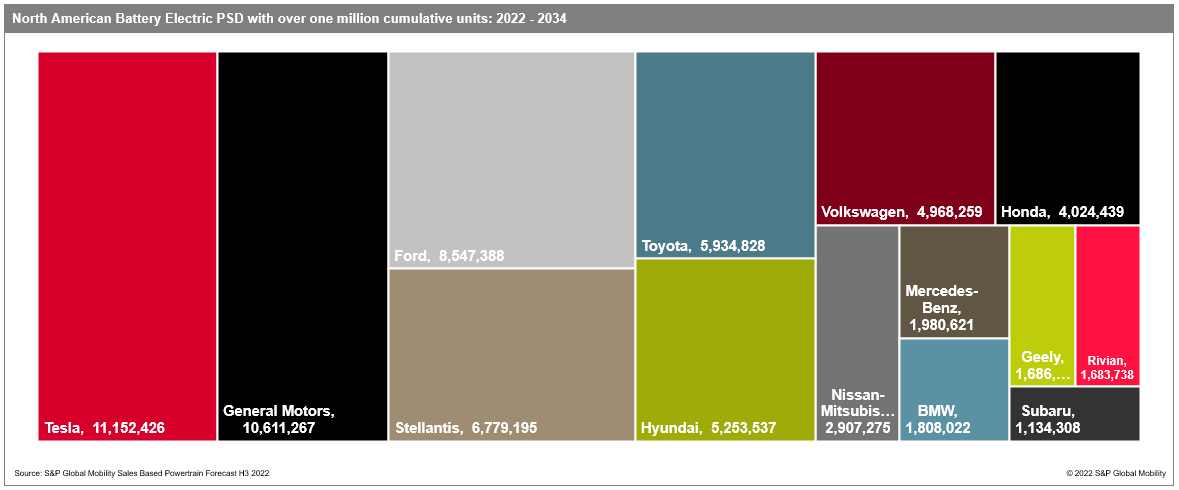

S&P World wide Mobility predicts the number of battery-electric

nameplates will mature from 48 at present to 159 by the conclusion of 2025,

at a tempo speedier than Tesla will be able to incorporate factories. Tesla’s

CEO Elon Musk confirmed (again) for the duration of a modern earnings simply call that

the organization is working on a car or truck priced decreased than the Design 3,

although sector launch timing is unclear.

Tesla’s product assortment is envisioned to expand to involve Cybertruck in

2023 and sooner or later a Roadster, but mainly the Tesla product lineup

in 2025 will be the same versions it features today. (Tesla is also

scheduling to provide a business semi-truck by the conclusion of 2022, but

it would not be factored into light-weight-auto registrations.)

“In advance of you truly feel also terribly for Tesla, however, bear in mind that the

manufacturer will keep on to see device gross sales expand, even as share

declines,” mentioned Stephanie Brinley, associate director,

AutoIntelligence for S&P Worldwide Mobility. “The EV industry in

2022 is a Tesla industry, and it will proceed to be, so long as its

competitors are certain by output ability.”

Tesla has opened two new assembly crops in 2022 and is searching

for the internet site of its subsequent North American plant. Tesla these days is the

model greatest geared up for having advantage of the instant surge in

EV demand, although producing investments from other automakers

will erode this gain sooner than afterwards.

The competitors

All through 2022, EVs have obtained market share and customer

focus. In an atmosphere in which automobile sales are minimal by

inventory and availability, EVs have received 2.4 details of industry

share 12 months about calendar year in registration information compiled via

September – reaching 5.2% of all mild car registrations –

according to S&P Worldwide Mobility facts.

The nascent phase of marketplace progress leaves some others competing for

volume at the decreased close of the cost spectrum. New EVs from

Hyundai, Kia and Volkswagen have joined Ford’s Mustang Mach-E,

Chevrolet Bolt (EV and EUV) and Nissan Leaf in the mainstream model

room. In the meantime, luxurious EVs from Mercedes-Benz, BMW, Audi,

Polestar, Lucid, and Rivian – as properly as huge-ticket things like the

Ford F-150 Lightning, GMC Hummer, and Chevrolet Silverado EV – will

plague Tesla at the substantial conclude of the industry.

With the Product Y and Model 3 merged having 56% of EV

registrations, the other 46 cars are competing for scraps right up until

EVs cross the chasm into mainstream appeal. (A modern S&P

International Mobility investigation showed the Heartland

states have but to embrace electric autos.)

“Assessing EV sector effectiveness necessitates searching by means of a

lower-quantity lens than with classic ICE goods,” Brinley

said. “But advancement prospects for EV merchandise are solid, investment decision

is substantial and the regulatory environment in the US and globally

implies that these are the remedy for the foreseeable future.”

Manufacturing volumes right now are limited by factory capacity, the

semiconductor scarcity and other offer chain issues, as very well

as customer desire. But the concern of creation ability is staying

resolved, as automakers, battery manufacturers and suppliers pour

billions into that side of the equation. However there are several

signals suggesting consumer desire is superior and that extra purchasers could

be inclined to make the changeover – and to do so faster than

anticipated even a calendar year ago.

But customer willingness to evolve to electrification remains

the largest wildcard. Looking earlier Model Y and Design 3, no solitary

design has attained registrations earlier mentioned 30,000 models through the

1st three quarters of 2022. The 2nd-greatest-promoting EV brand name in

the US is Ford. Nevertheless, Mach-E registrations of about 27,800 units

are about 8% of the volume Tesla has captured, in accordance to S&P

World wide Mobility knowledge.

Tesla has 4 of the top 5 EV styles by registration in the

sixth via 10th positions are the Chevrolet Bolt and Bolt EUV,

Hyundai Ioniq5, Kia EV6, Volkswagen ID.4 and Nissan Leaf. Via

September, the Bolt has observed about 21,600 automobiles registered,

Hyundai and Kia are in the 17,000-18,000-unit assortment, and VW

approached 11,000 models. Like the tenth-location Leaf, no other

EV has experienced registrations over 10,000 units about the initial nine

months of 2022.

That stated, there are caveats. Volkswagen’s small volumes are

impacted by provide chain snarls and market allocations to far more

EV-welcoming regions – issues Hyundai and Kia also experience. Having said that,

VW’s new ID.4 assembly line in Tennessee went stay in Oct the

automaker claimed at the plant opening that it experienced 20,000 unfilled

reservations and a plant ability of 7,000 models per month.

That must alter the EV volume photograph considerably. A seem

at the around 525,000 EVs registered above the first nine months of

2022 exhibits the EV marketplace currently continues to be in the palms of affluent

potential buyers, who are spending additional on their automobiles than ICE

customers.

While logic dictates that even more advancement will have to have more EVs

currently being provided in the $25,000-$40,000 price tag variety, the willingness

of prospective buyers to spend much more right now reflects an aspirational mother nature to

the choice.

Tesla’s EV-only method offers it a retention gain – as several

EV homeowners have returned to ICE powertrains. But as new EVs arrive,

loyalty will be tested. At the moment, the Product Y has a 60.5% -brand name

loyalty and experienced nearly 74% of buyers appear from exterior the brand name

(the conquest charge) – tops in the market. Who is Tesla

conquesting from? Toyota, Honda, BMW and Mercedes-Benz. Toyota and

Honda are only beginning to get into the EV marketplace, while have nonetheless

to enter the fray in earnest.

Notice: This chart reflects S&P World-wide Mobility North

American cumulative sales forecast for BEVs 2022-2034.

The race to marketplace

Honda owners in certain are demonstrating an interest in electrical

vehicles. However for Honda, its to start with EV (a midsize SUV

shared with GM) is just not envisioned till 2024, whereupon the second

50 percent of this 10 years sees a flurry of activity. That still offers

the problem of reconnecting with house owners who have defected from

the Honda brand.

In its meteoric growth, Tesla has conquested Japanese icons: The

leading five Product Y conquests are the Lexus RX, Honda CR-V, Toyota

RAV4, Honda Odyssey, and Honda Accord. Meanwhile, the major 5

Product 3 conquests are the Honda Civic, Honda Accord, Toyota Camry,

Toyota RAV4 and Honda CR-V. So even even though the all round market has

ditched sedans for SUVs, there stay some who desire a sedan in

electrified sort.

But it can be not just Tesla profitable over individuals of the massive two

Japanese brand names. Early knowledge of the 27,800 registrations of the Ford

Mustang Mach-E as a result of September, reveals equivalent conquest patterns:

The top Mach-E conquest model has been the Toyota RAV4 (irrespective

of powertrain), followed by the Honda CR-V and Jeep Wrangler. The

Mach-E is also dealing with registrations at a lower MSRP assortment –

43% of registrations experienced an MSRP under $50,000. For Ford, a lot more than

63% of registrations from January by September 2022 were

conquests from other manufacturers.

Following the Mustang Mach-E, the future leading EV is the Chevrolet Bolt

(EUV and EV). The Bolt is likely to continue on to attain floor, as it

expended most of the drop and winter season of 2021-22 in creation hiatus

as Chevrolet solved a warranty concern, and then observed a rate

reduction before long following output re-began. With output back

on the internet, a a lot more attractive value, and GM’s programs to enhance Bolt

capability in 2023, the auto has probable to hold growing. The

Bolt also sees RAV4, CR-V and Prius as its major three conquest

types.

And whilst the Hyundai Ioniq5 is limited in its geographic

distribution (and faces comparable capability and world-wide need challenges

as VW ID.4), S&P World-wide Mobility conquest data exhibit most Ioniq5

customers formerly owned a Toyota RAV4, Honda CR-V, Mazda CX-5 or

Subaru Forester. Of the top rated 10 Ioniq5 conquests, only two are from

the regular Detroit A few brands, with the Chevrolet Bolt at

seventh and Jeep Wrangler at tenth.

Of course, the high conquest premiums from Toyota and Honda occur

from the historic profits success of those people designs over-all. The RAV4

is the very best-marketing non-pickup truck in the US, which means there

are more RAV4 consumers to conquest. The Camry, Accord, and CR-V

adhere to close driving.

Alongside this route, on the other hand, these EVs are looking at minor conquest

of the F-Series or Chevrolet Silverado pickup truck. In the S&P

World Mobility garage mate details, nonetheless, we see a potent F-Sequence

illustration. It reveals up as a prime garage mate for the Mustang

Mach-E the Bolt does see the Silverado as its major garage mate, the

F-Collection is following. F-Collection is also the leading garage mate for the

Ioniq5, EV6 and ID.4.

“Although modern EV prospective buyers are not offering up their pickups in

favor of heading electric, it also indicates that there is a pool of

EV entrepreneurs, who are also total-size pickup homeowners, getting established,”

Brinley stated. “We know that EV house owners have a tendency to be faithful to EV

propulsion. This intersection can provide aid for EV pickup

adoption.”

An current pool of current EV owners who also have pickups can

be a advantage for the efforts in the entire-sizing EV pick-up house,

specifically for the Ford F-150 Lightning, Chevrolet Silverado EV

and GMC Sierra EV, every single of which is aimed at a traditional pick-up

use circumstance and operator. The Rivian R1T, GMC Hummer EV and Tesla

Cybertruck every occupy a lifestyle pickup place, geared toward

innovator buyers and statement-makers, and could be a lot more most likely to

conquest consumers to the pickup segment as very well as to an EV invest in.

But for now, electrical autos keep on being the provenance of sedans and

little SUVs.

Notice: All loyalty knowledge is primarily based on the S&P World

Mobility house loyalty methodology, which may indicate an

addition to the garage and not necessarily a disposal.

Please contact [email protected] to obtain out more

information and facts around our insights to assistance you make information-driven

choices with conviction.

This article was released by S&P World Mobility and not by S&P World wide Rankings, which is a independently managed division of S&P International.