Plenty of ’22 models still on the shelf

For all the talk of low inventories, and car dealers tacking

“market adjustments” on top of MSRP, there were nearly a

half-million units of leftover 2022 model year vehicles still

advertised for sale in the United States heading into the first

weekend of December. That is on top of the 2023 vehicles that have

been arriving on dealer lots.

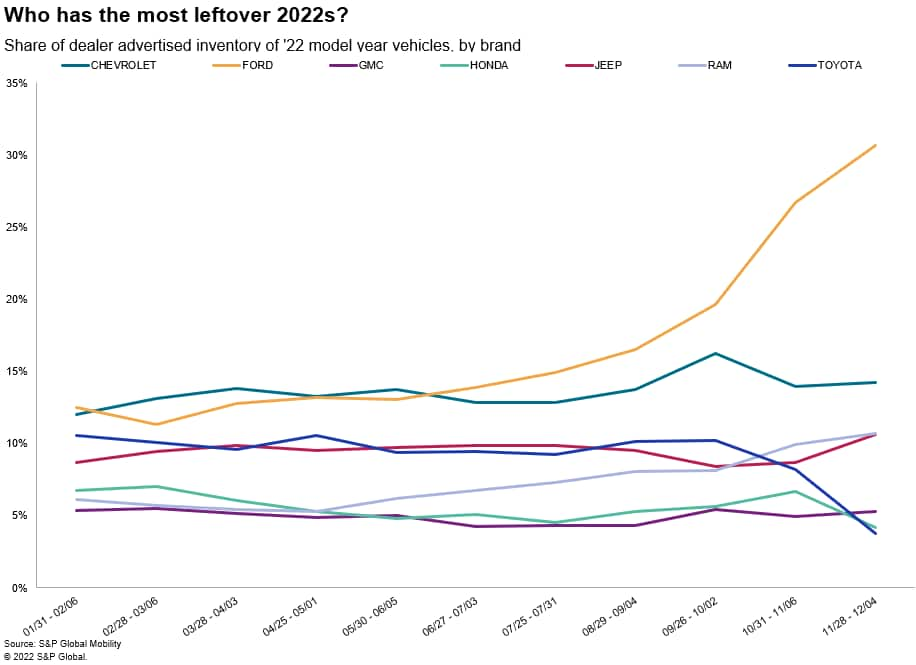

According to S&P Global Mobility’s analysis of US dealer

advertised inventory data, mainstream brands Ford, Chevrolet, Ram,

and Jeep had about 300,000 units of 2022 models advertised as

available for sale the week ending December 4. Those four brands

account for 71% of 2022 advertised inventory listed by mainstream

brand dealers – and 66% of all dealer-advertised inventory when

including luxury marques.

Among luxury brands, Mercedes-Benz and Lincoln still showed the

most remaining 2022 vehicles in dealer advertised inventory,

according to the S&P Global Mobility analysis.

While most automakers traditionally ease off production in late

summer to transition to the new model year, and clear out the last

of their old models by Christmas, certain automakers actually have

seen their 2022 inventories increase in October and November.

“Model year discipline has ebbed,” said Cheryl Woodworth,

consulting associate director for S&P Global Mobility. “With

the chip shortage, inventory control is not as meticulous as it

used to be.”

Is running old inventories into the new model year a bad thing?

It can be for automakers, but it could spell retail relief for

consumers. With ’22 models carrying the stigma of being “older” –

even if the 2023 model is unchanged – that can mean dealers are

incentivized to blow out the zero-miles ’22s.

“The longer you wait to change over your model year, the more it

hits your residual values in terms of tougher grading,” Woodworth

said.

Some dealers are offering below-MSRP discounts on vehicles that

carried sticker-price-plus Monroney labels just months before. And

with consumer demand waning due to external economic forces such as

inflation and recession-related layoffs, the pressure to move the

metal increases.

Usually, the inventory arc for each model year follows a

predictable curve, peaking in spring as production hits its stride,

and then descending in summer during the annual selldown and the

model year transitions in September and October. But supply chain

chaos has made it impossible for some automakers to follow

tradition.

That said, with certain elements of the supply chain still in

flux, it might make sense for manufacturing continuity to continue

building 2022 models if a 2023 minor model change includes a part

that is not readily available, Woodworth said.

In November, Ford was still delivering 2022 Escapes to

dealerships from its Louisville factory, as the 2023 minor model

change is still ramping up. The same continuation of late

production ’22 models applies to the Ford Bronco Sport and Lincoln

Corsair, which share many of their underpinnings with the Escape

platform.

Remaining 2022 units are often specific to certain models. In

the market for a luxury SUV? The models with the highest remaining

2022 model year units are the Mercedes-Benz GLC and Lincoln

Corsair.

Why the excess ’22 Mercedes GLCs? It’s still awaiting a 2023

freshening – the national mbusa.com website still wasn’t listing

the 2023 as available on December 15 – and as such 2022 models are

still in strong supply. Among luxury brands, Mercedes had 33% share

of remaining ’22 models still advertised the week ending December

4, while Lincoln accounted for 22% share of leftover luxury

’22s.

That said, Mercedes dealers have done a strong job of selling

down its 2022 inventories from mid-summer in anticipation of the

’23 model arriving. And other key Mercedes volume models – GLE,

S-Class, and C-Class – are mostly represented by 2023 model

production.

Supply chain hiccups also are affecting inventories in other

ways. Tens of thousands of so-called “ghost units” of the F-150 and

Chevrolet Silverado have rolled off the assembly line but were

missing crucial parts, and have been collecting in parking lots

near their respective factories until they can be released. On top

of those unfinished units, Ford dealers had nearly as many F-150s

advertised the week ending December 4 as they did in August in

September. When the ghost units finally receive their needed parts

and enter wholesale inventory – Ford hopes it will happen by the

end of December – that will add to the pressure to clear out the

’22 models at the dealer level.

The combined black-swan events of COVID, semiconductor

shortages, and the Russian invasion of Ukraine disrupted

traditional manufacturing and supply norms – the latest downstream

impact being the overrun of prior model-year production and

inventory. How the industry can recover to its regular cadence

depends on its adaptability to these continued disruptions.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.